What is leverage in trading?

| Financial Instruments | Maximum Leverage | Margin Requirement |

|---|---|---|

| Major FX | 500:1 | 0.20% |

| Minor FX | 200:1 | 0.50% |

| Gold | 200:1 | 0.50% |

| Major Indices | 500:1 | 0.20% |

| Minor Indices | 100:1 | 1% |

| Commodities | 100:1 | 1% |

| Stocks | 10:1 | 10% |

How does leverage work?

Leverage

50:1

Leverage

100:1

Leverage

200:1

What is dynamic leverage?

Dynamic leverage is a risk management tool brokers use. It’s a right some brokers decide to implement to avoid large positions causing high risks.

Although trading accounts have different leverage tiers at the time of creation, some instruments can have different leverages. The symbol leverage won’t surpass the leverage of the account, and the account leverage will be set as the maximum. Likewise, if the account leverage is higher than the symbol leverage, the symbol will be set as the maximum.

| Tier | Open USD Volume | Maximum Leverage |

|---|---|---|

| Tier 1 | 0-2,000,000 | 500:1 |

| Tier 2 | 2,000,000-5,000,000 | 200:1 |

| Tier 3 | 5,000,000-10,000,000 | 100:1 |

| Tier 4 | 10,000,000-20,000,000 | 50:1 |

| Tier | Open USD Volume | Maximum Leverage |

|---|---|---|

| Tier 1 | 0-100,000 | 500:1 |

| Tier 2 | 100,000-300,000 | 200:1 |

| Tier 3 | 300,000-500,000 | 100:1 |

| Tier 4 | 500,000-15,000,000 | 50:1 |

| Tier | Open USD Volume | Maximum Leverage |

|---|---|---|

| Tier 1 | 0-100,000 | 200:1 |

| Tier 2 | 100,000-300,000 | 100:1 |

| Tier 3 | 300,000-500,000 | 50:1 |

| Tier 4 | 500,000-15,000,000 | 20:1 |

Benefits of using leverage trading

Trade on both rising and falling markets

Open either short or long positions according to the market conditions and your trading strategy.

Leveraged trading

You need significantly less capital to open a trade in comparison to owning the underlying asset. Leverage can significantly increase your gains as well as losses.

Regulated environment

Trading with Skilling ensures a regulated environment, segregation of all client deposits, and client-focused customer support.

Fast execution

Ultrafast order execution of 8 milliseconds on average on FX. No dealing desk intervention. Your order gets routed automatically to one or several of our liquidity providers, ensuring your trade is always matched and filled quickly and efficiently.

- High exposure to the market: margins are the needed capital to enter a trade. With small percentages traders have higher exposure to the underlying asset, which can then turn into large profits if the market moves as expected.

- 24/5 market: although this depends on the markets/instruments, key markets are available to trade 24 hours a day, 5 times a week, with the exception of cryptos, which can be traded all week.

- Mitigate Against Low Volatility: this is specially key for forex trading. In periods at which market volatility is low, leverage trading increases the exposure. With a higher exposure, even small movements can have a big impact in returns (or losses).

- Capital efficiency: with higher exposure, the effort to make certain profits are going to be smaller than with traditional investing. The capital can then be reinvested repeatedly in the short term increasing the efficiency at which you are using your capital.

Leverage is particularly risky in volatile markets, where share prices can move rapidly and unpredictably. This was seen in February 2021, when the share prices of Gamestop and AMC Entertainment suddenly skyrocketed due to activity on Reddit. These so-called meme stocks were heavily shorted by hedge funds, who bet that their price would fall. When amateur investors began buying up the stock, it forced the hedge funds to cover their positions by buying back the stock at a much higher price. This caused a sharp decline in the value of other meme stocks such as NIO and GME. Amateur investors who had leveraged their positions were quick to lose money as the market quickly corrected itself.

Importance of risk management in trading with leverage

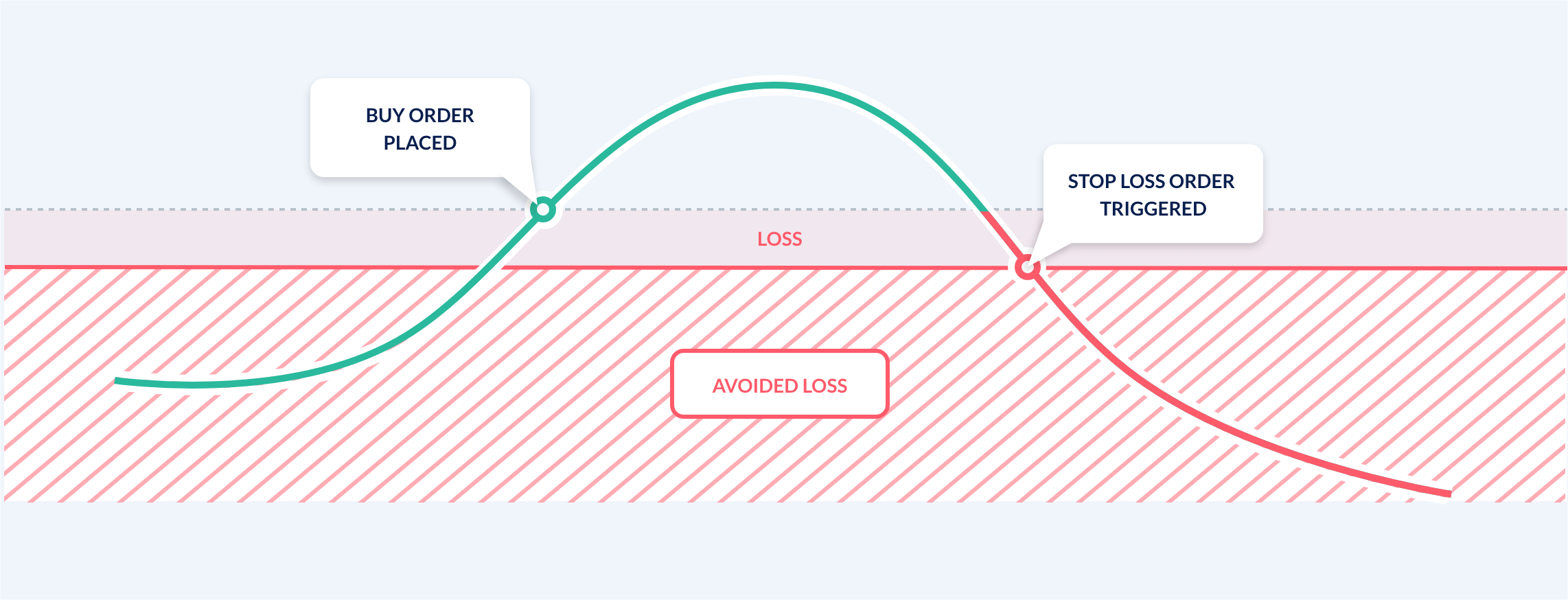

Before opening a trading position, it’s very important to consider the cash needed but also the maximum loss we are willing to take, or the target we’d like to achieve. Stop loss and limit orders allow traders to set a specific price at which an instruction to buy or sell will be triggered.

But these are not the only elements affecting risk management. Equally important is planning your trades before getting started and after carrying out in-depth analysis (whether it’s technical/fundamental or a combination of the two).

Also key is calculating the expected return to set goals or diversifying and hedging your portfolio

Leverage trading can provide traders with the opportunity to make high returns without the need to own a large amount of capital, but also it can turn into big losses and hence the importance of risk management and trading education.