The practice of trading Contracts For Difference (CFDs) is a method of speculating on the price movements of assets in the financial markets without needing to buy and sell any of the underlying assets.

CFDs are made for traders who want to take advantage of both rising and falling markets as it gives traders the chance to speculate on whether an asset’s price will move up or down - without ever having to own the asset itself!

A Contract For Difference (CFD) is an arrangement or contract made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are settled by cash and there is no delivery of physical goods or securities.

In contrast to traditional investments, CFDs allow traders to not only take positions on falling prices but also on rising ones. CFDs are cash-settled but usually allow ample margin trading so that investors need only put up a small amount of the contract's notional payoff.

So how do CFDs work?

You’ve got leverage

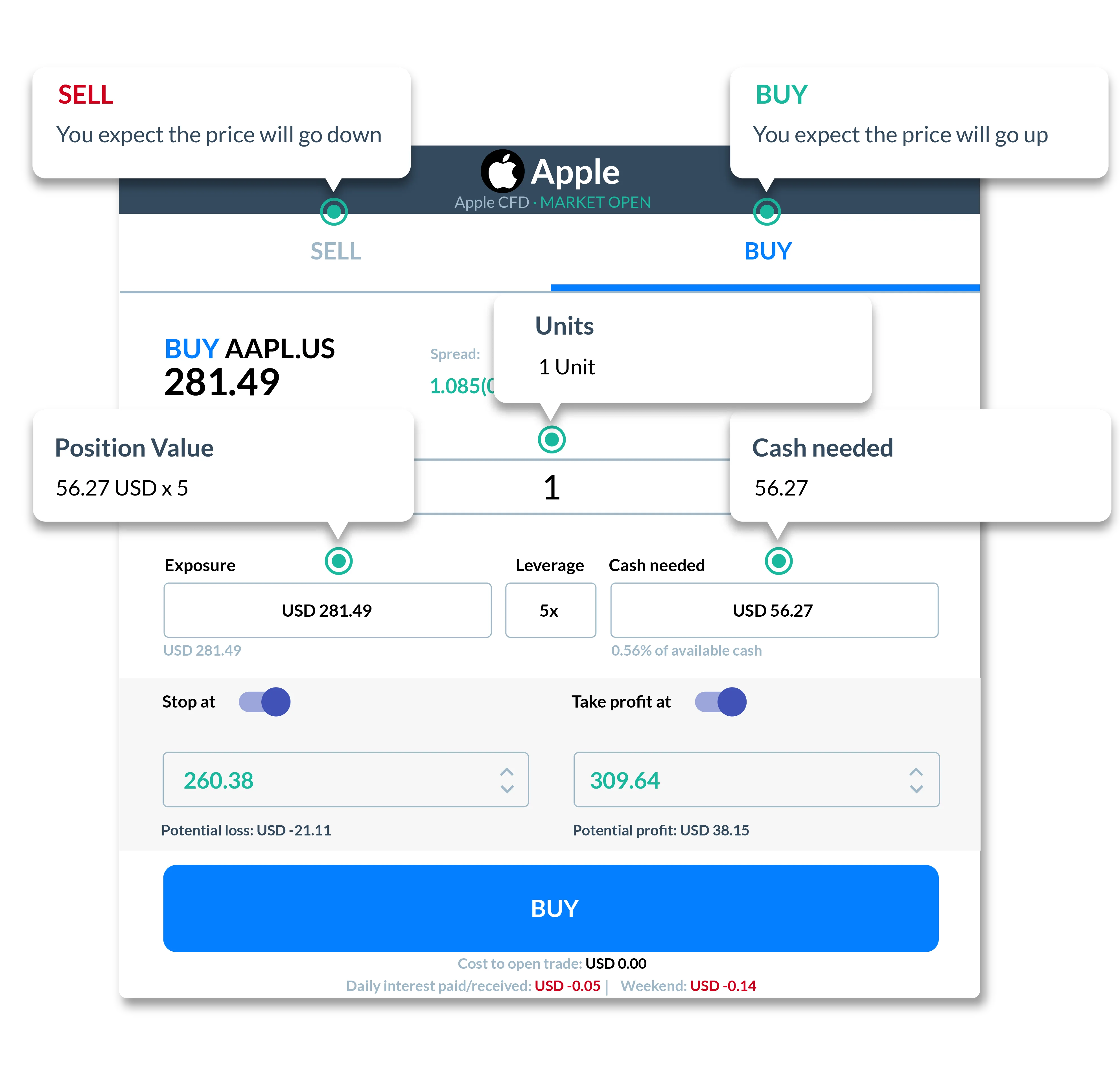

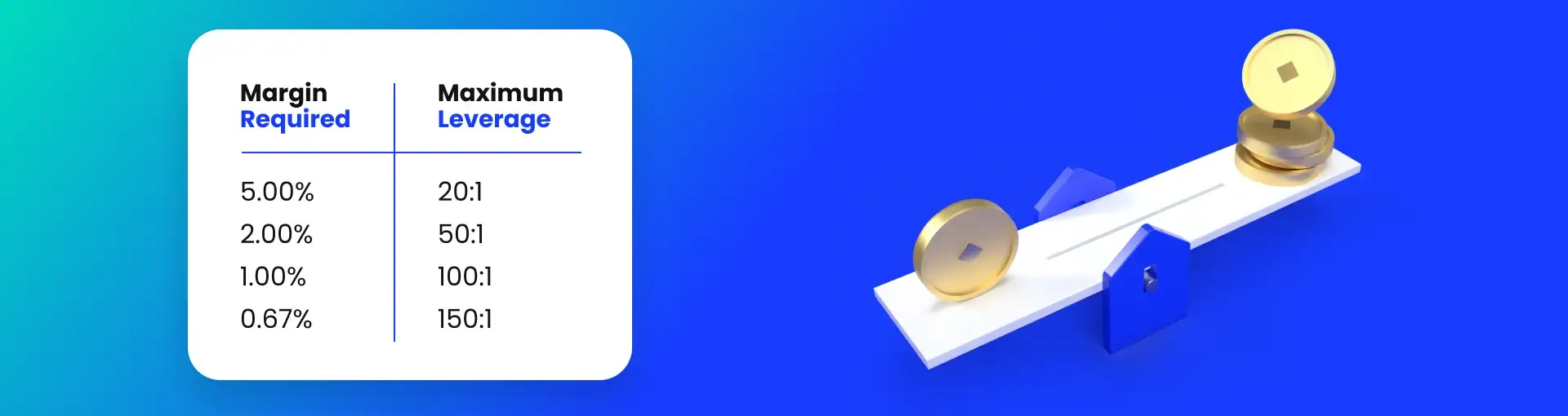

With CFD trading you put down a fraction of the value of your trade. This significantly enhances your buying power. By multiplying your original investment by a ratio (the leverage), you are allowed to control a position much larger than the original amount you invested.

For example, with an investment of $1,000 and leverage of 1:30, you can buy or sell an asset that is worth 30 times that much i.e. $1,000 x 30 = $30,000.

As you only need to deposit a percentage of the total CFD trade value, the market exposure that leveraged CFD contracts provide is what makes this type of trading so appealing. But it’s also important to understand the associated risk: CFD traders have as much exposure in losing trades as they do in winning ones. This is where education is vital.

Moving onto margin

The simplest way to understand this: leverage multiplies your amount invested, while margin is the required amount invested for any given trade. This initial deposit is the margin. So, say you want to open a trade that is worth $120,000 and the leverage on that asset class is 1:30, your required margin (amount invested) will be $120,000 / 30 = $4,000. This means you pay a small proportion of the value of the underlying shares to open the position, instead of paying the full value for the underlying shares.

NOTE: Leverage and margin requirement varies between 1:2 to 1:30 depending on the asset class traded by retail clients. More detailed information can be found here.

Short and long CFD trading explained

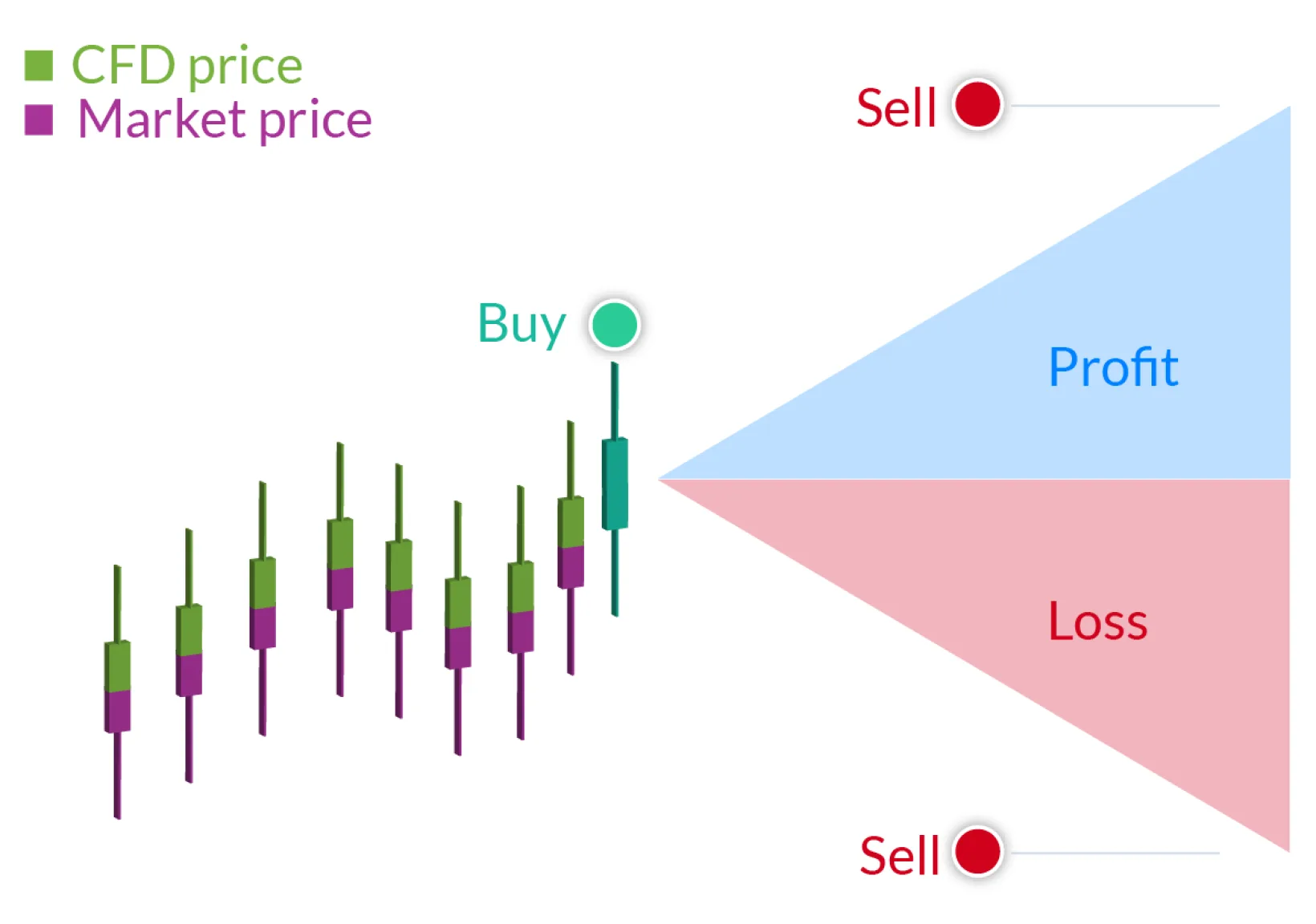

The exposure that leverage provides in CFD trading affects winning or losing trades. In the example below you’ll see the impact leverage has both ways. Profits and losses are calculated by looking at the difference in price between the initial price at which the CFD is bought or sold, and when the trade is exited (based on the speculation of asset prices in specific market conditions).

What is Selling short?

It is simply the opposite of buying “long” - the only significant difference is which direction you expect the stock price to move in. A short position is one that bets against the market, profiting when prices decline while a long position involves buying an asset in hopes the price will rise.

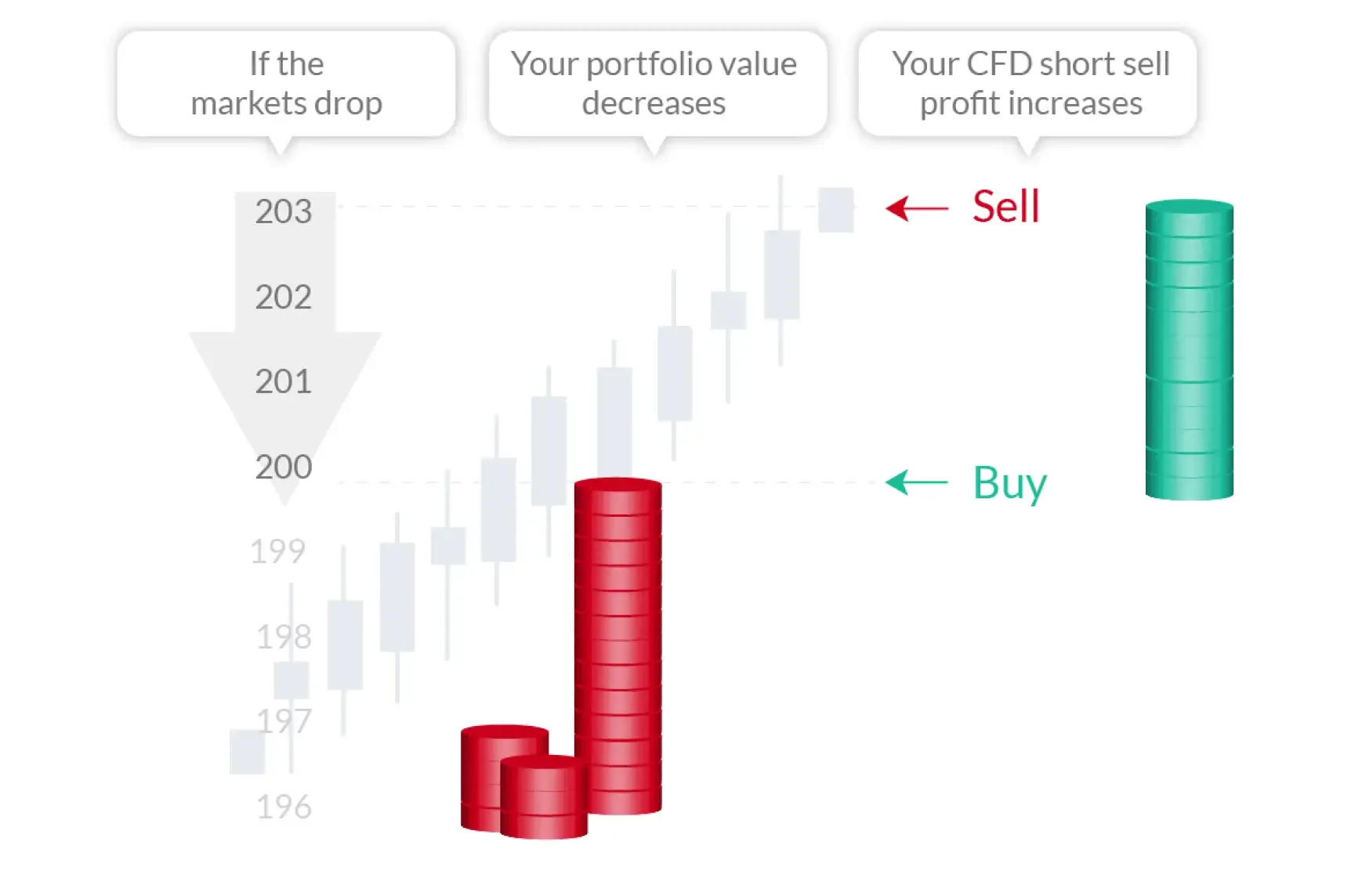

Short-selling CFDs in a falling market

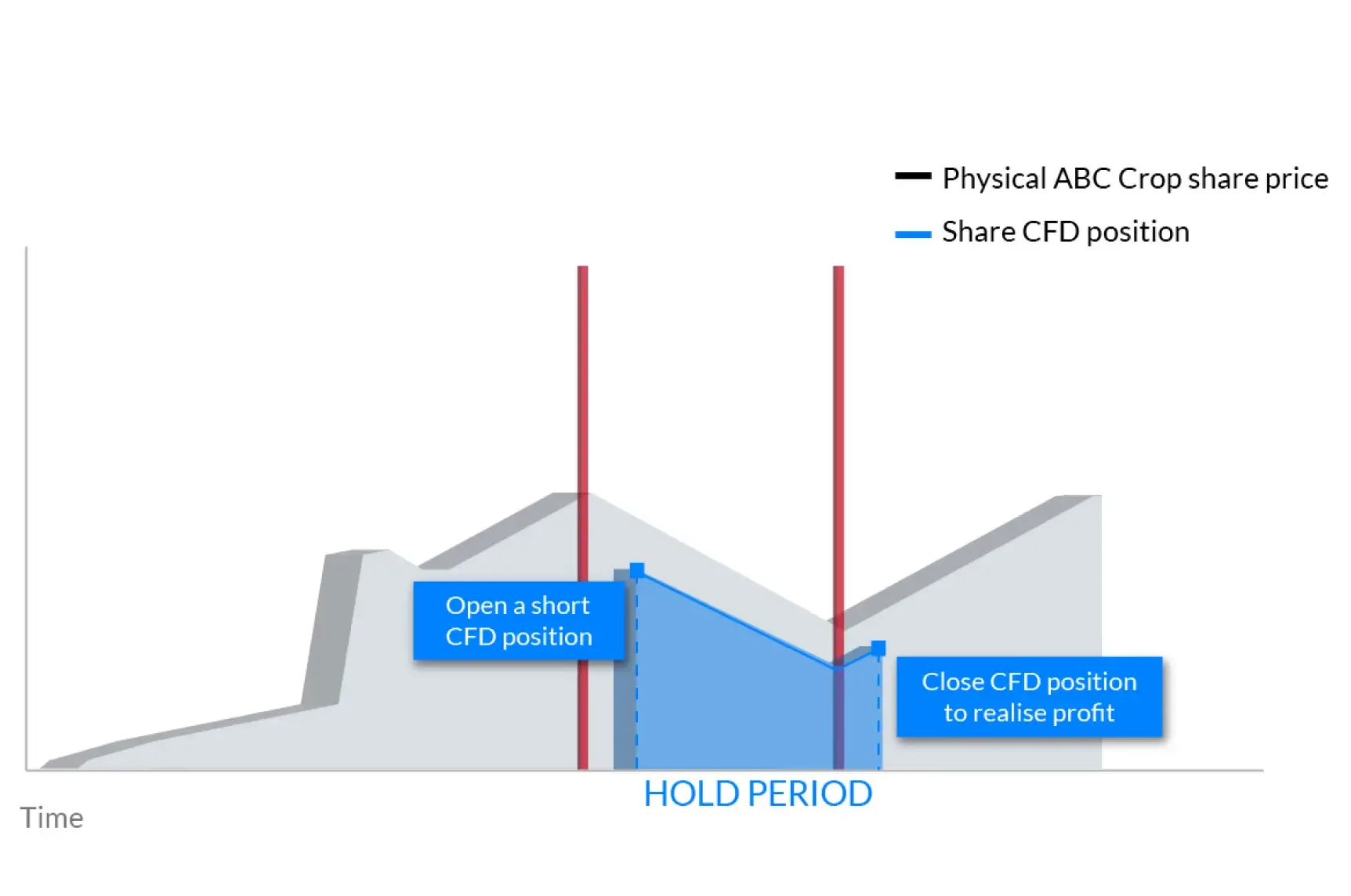

Hedging your physical portfolio with CFD trading

3 reasons why traders prefer CFDs

- It provides investors with all of the benefits and risks of owning a security without actually owning it.

- The use of leverage allows investors to put up a small percentage of the trade amount.

- Investors are able to easily take a long or short position or a buy and sell position.

At a quick glance

| Advantages of CFDs | Disadvantages of CFDs |

|---|---|

| Higher leverage | Traders pay the spread |

| Professional execution with no fees | Regulated only in some jurisdictions |

| No day trading requirements | Higher risks |

| Global market access from one platform | |

| No shorting rules or borrowing stock |

Why trade CFDs with Skilling?

Trade on both rising & falling markets

Leveraged trading

Regulated environment

Fast execution

Wider Offer of Instruments

Hedging

How do CFDs compare against other financial assets?

Share CFDs

What are the costs of CFD trading?

Swap fees (a.k.a interest, rollover or overnight fees)

More info on spreads, commissions and other fees and charges can be found here.

At the end of each trading day (at 21:59 GMT), any positions open in your account may be subject to a charge called a swap fee, a cost which can be positive or negative depending on the direction of your position and the applicable interest rates.

Please note: calculation formula may vary according to instrument type.

Holding costs

How do I trade CFDs?

- Open a trading account

- Find an opportunity

- Take a position

- Monitor your position