The Skilling NFP preview - March 2023

Non-Farm Payrolls Preview - Next release due at GMT 01:30 PM March 10th, 2023

Skilling NFP Preview

The last NFP report before the March US interest rate decision

February United States Nonfarm Payrolls expected to lose -300,000 jobs

Lower NFP forecasted compared to the previous period, but still points to strong US labour conditions

The current US unemployment rate is at 3.4%, the lowest level in over 50 years. The previous NFP report indicated that 517,000 new jobs were created during January 2023. So, even with a drop of -300,000 jobs compared to January, the forecasted 200,000 new jobs created during February 2023 still implies that the US labor market remains strong.

Can strong US jobs data keep US stock indices pushing even higher into 2023?

Next US Jobs report:

Friday, March 10th, 2023 GMT 01:30 PM

On the 1st Friday of every month investors expect the release of the US nonfarm payrolls (NFP) report.

Since February was a short month with only 28 days, the March NFP report was pushed forward one week to March 10th.

| Date & Time | Country | Event | Previous | Forecast | Current Unemployment Rate |

|---|---|---|---|---|---|

|

Mar 10, 2023 1:30 PM GMT |

United States | Nonfarm Payrolls (NFP) | (January) 517,000 |

(February) 200,000 to 215,000 |

3.4% |

Experience Skilling's award-winning platform

Try out any of Skilling’s trading platforms on the device of your choice across web, android or iOS.

US unemployment at 53 year lows

Even if the February NFP misses expectations, does one report matter?

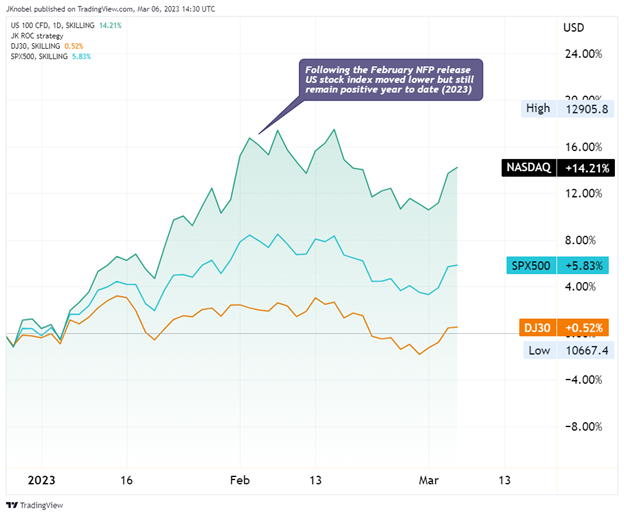

US100 Index leads the major US indices higher since the start of 2023

If price is a leading indicator, then the US100 year to date price action suggests that investors are not so concerned about the risk of the US economy falling into a deep recession. It seems like investors have been supporting risk assets even in the face of a strong labour market, “sticky” inflation, and the prospects of higher interest rates for a longer period of time.

Not investment advice. Past performance does not guarantee or predict future performance.