The practice of trading Contracts For Difference (CFDs) is a method of speculating on the price movements of assets in the financial markets without needing to buy and sell any of the underlying assets.

CFDs are made for traders who want to take advantage of both rising and falling markets as it gives traders the chance to speculate on whether an asset’s price will move up or down - without ever having to own the asset itself!

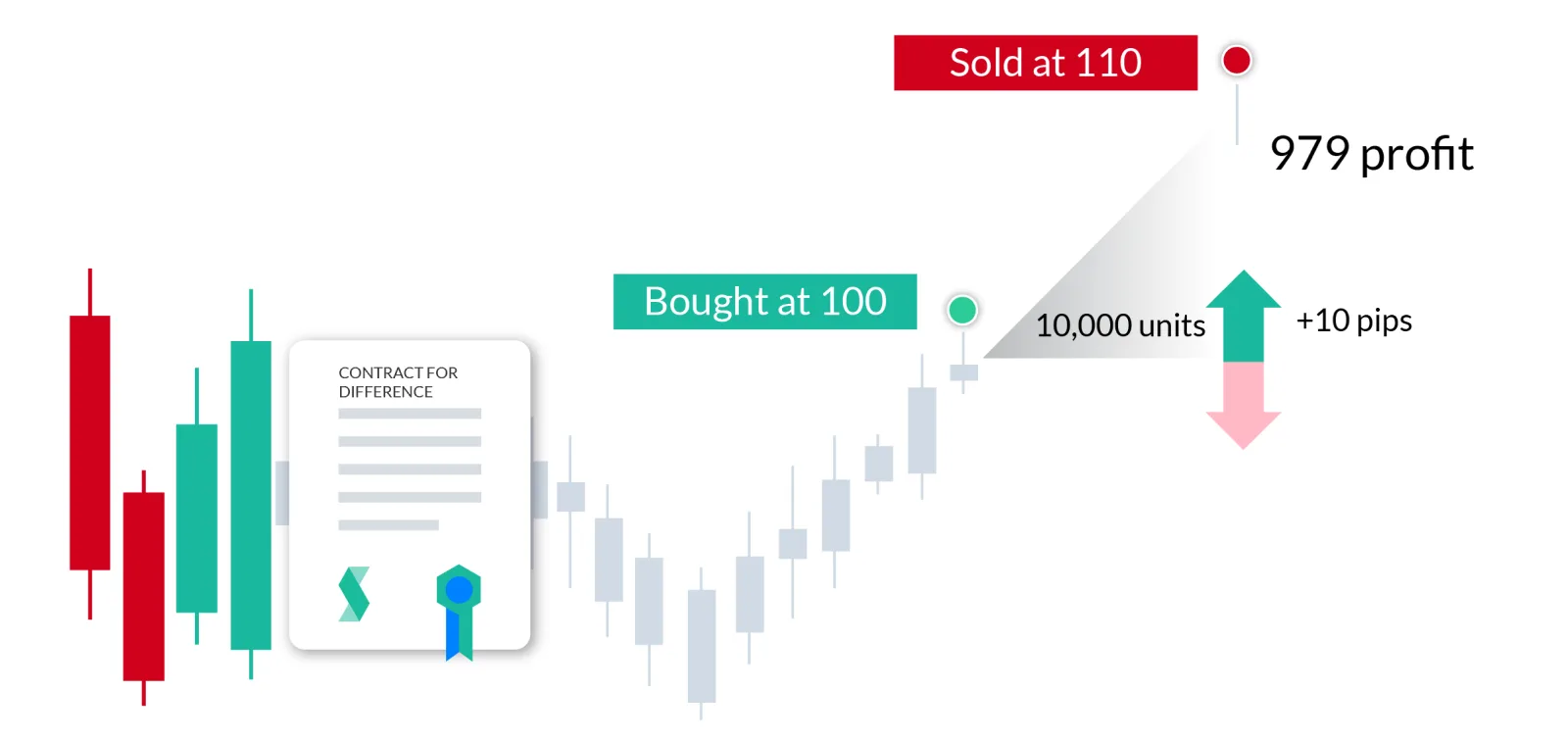

A Contract For Difference (CFD) is an arrangement or contract made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are settled by cash and there is no delivery of physical goods or securities.

In contrast to traditional investments, CFDs allow traders to not only take positions on falling prices but also on rising ones. CFDs are cash-settled but usually allow ample margin trading so that investors need only put up a small amount of the contract's notional payoff.

So how do CFDs work?

You’ve got leverage

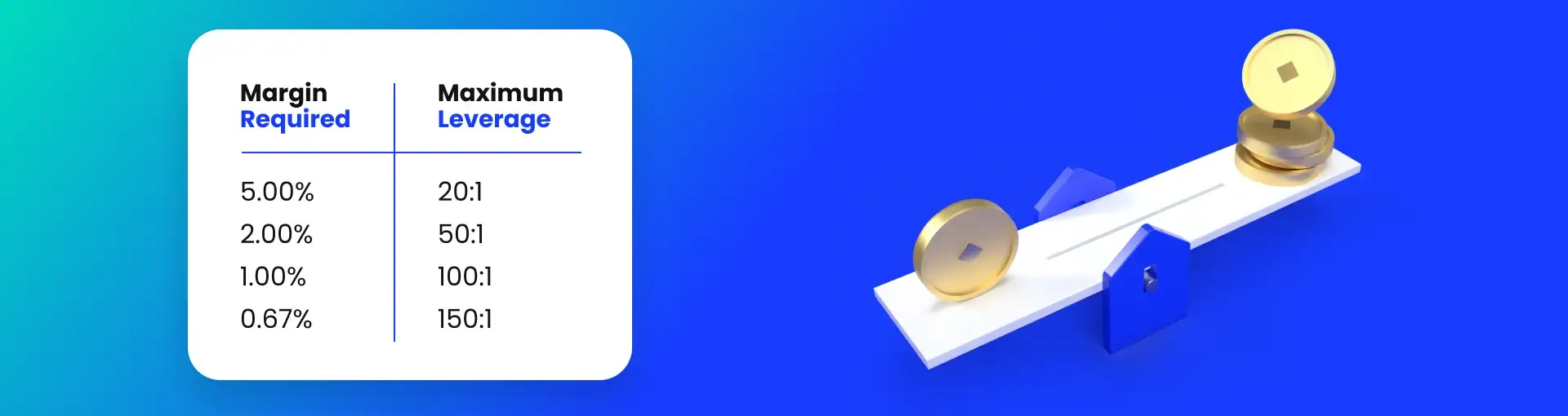

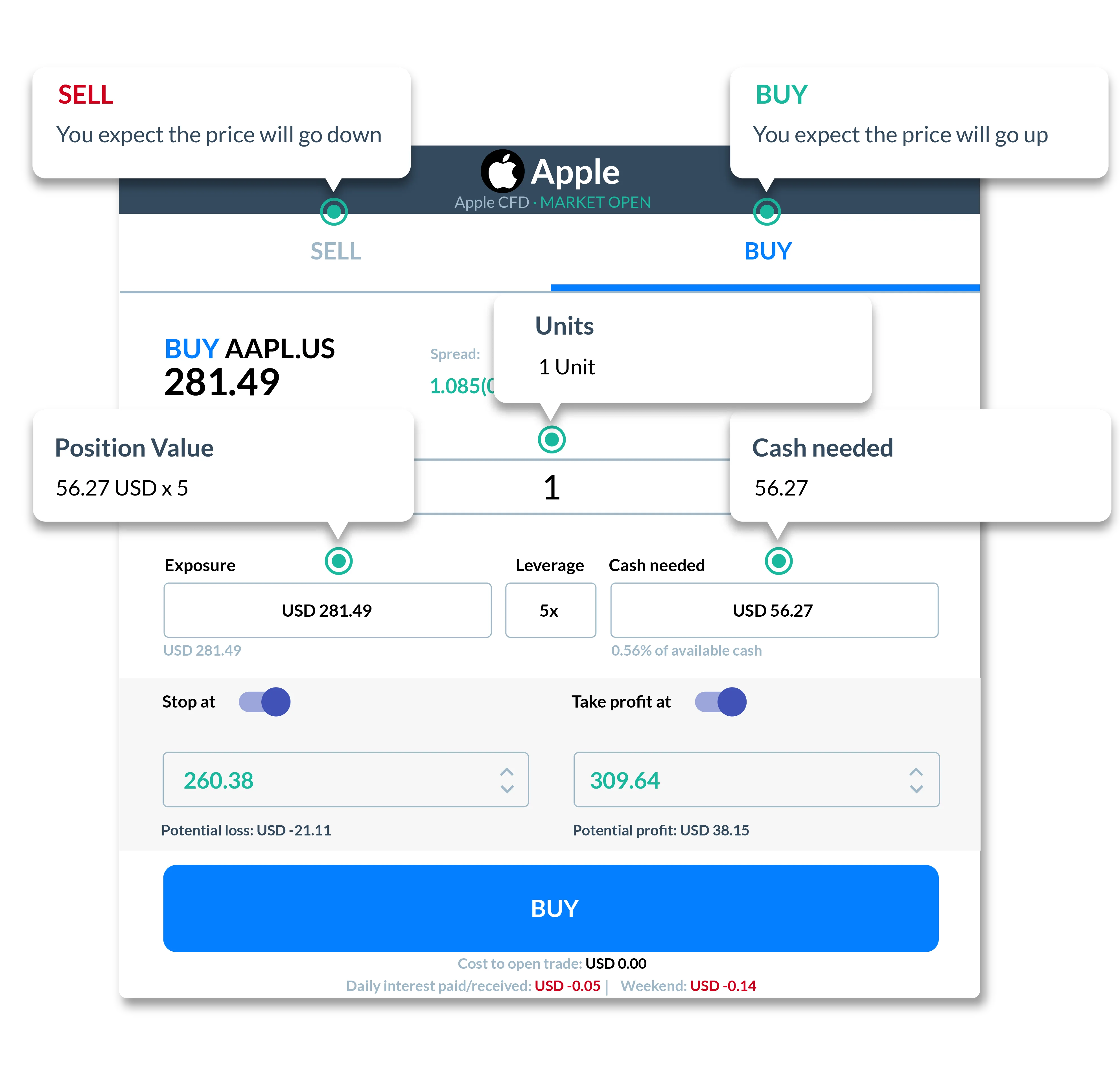

With CFD trading you put down a fraction of the value of your trade. This significantly enhances your buying power. By multiplying your original investment by a ratio (the leverage), you are allowed to control a position much larger than the original amount you invested.

For example, with an investment of $1,000 and leverage of 1:30, you can buy or sell an asset that is worth 30 times that much i.e. $1,000 x 30 = $30,000.

As you only need to deposit a percentage of the total CFD trade value, the market exposure that leveraged CFD contracts provide is what makes this type of trading so appealing. But it’s also important to understand the associated risk: CFD traders have as much exposure in losing trades as they do in winning ones. This is where education is vital.

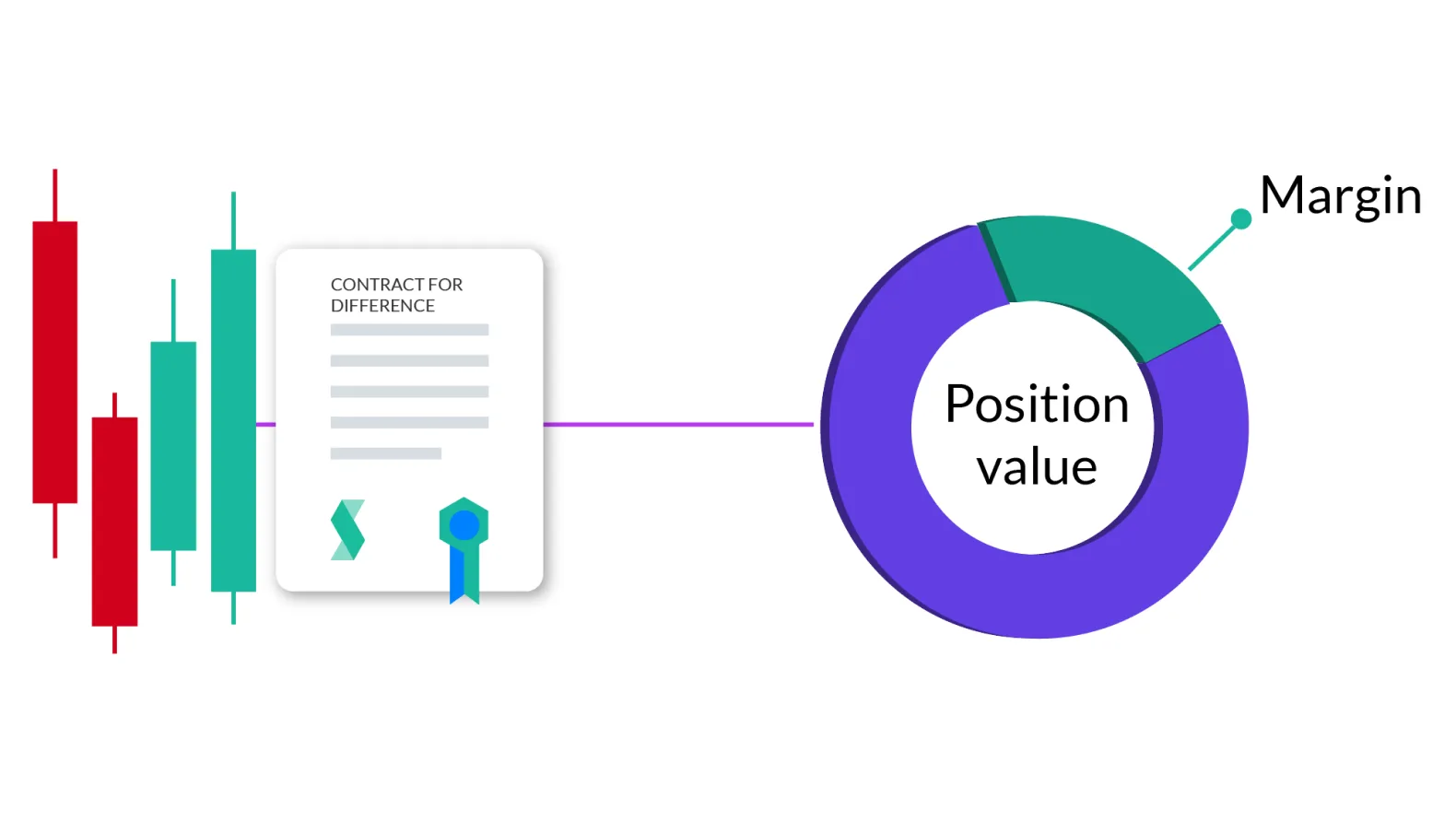

Moving onto margin

The simplest way to understand this: leverage multiplies your amount invested, while margin is the required amount invested for any given trade. This initial deposit is the margin. So, say you want to open a trade that is worth $120,000 and the leverage on that asset class is 1:30, your required margin (amount invested) will be $120,000 / 30 = $4,000. This means you pay a small proportion of the value of the underlying shares to open the position, instead of paying the full value for the underlying shares.

NOTE: Leverage and margin requirement varies between 1:2 to 1:30 depending on the asset class traded by retail clients. More detailed information can be found here.

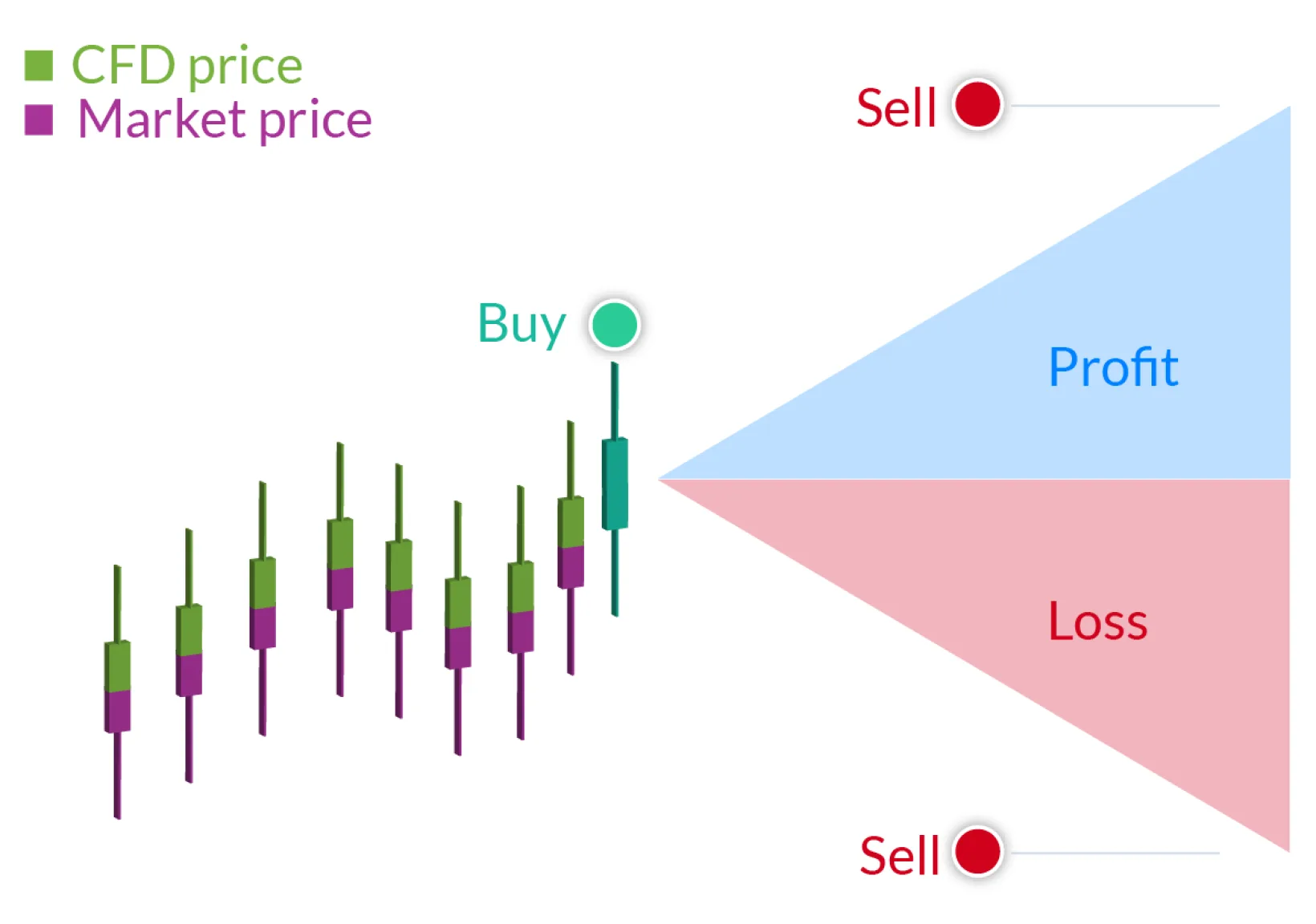

Short and long CFD trading explained

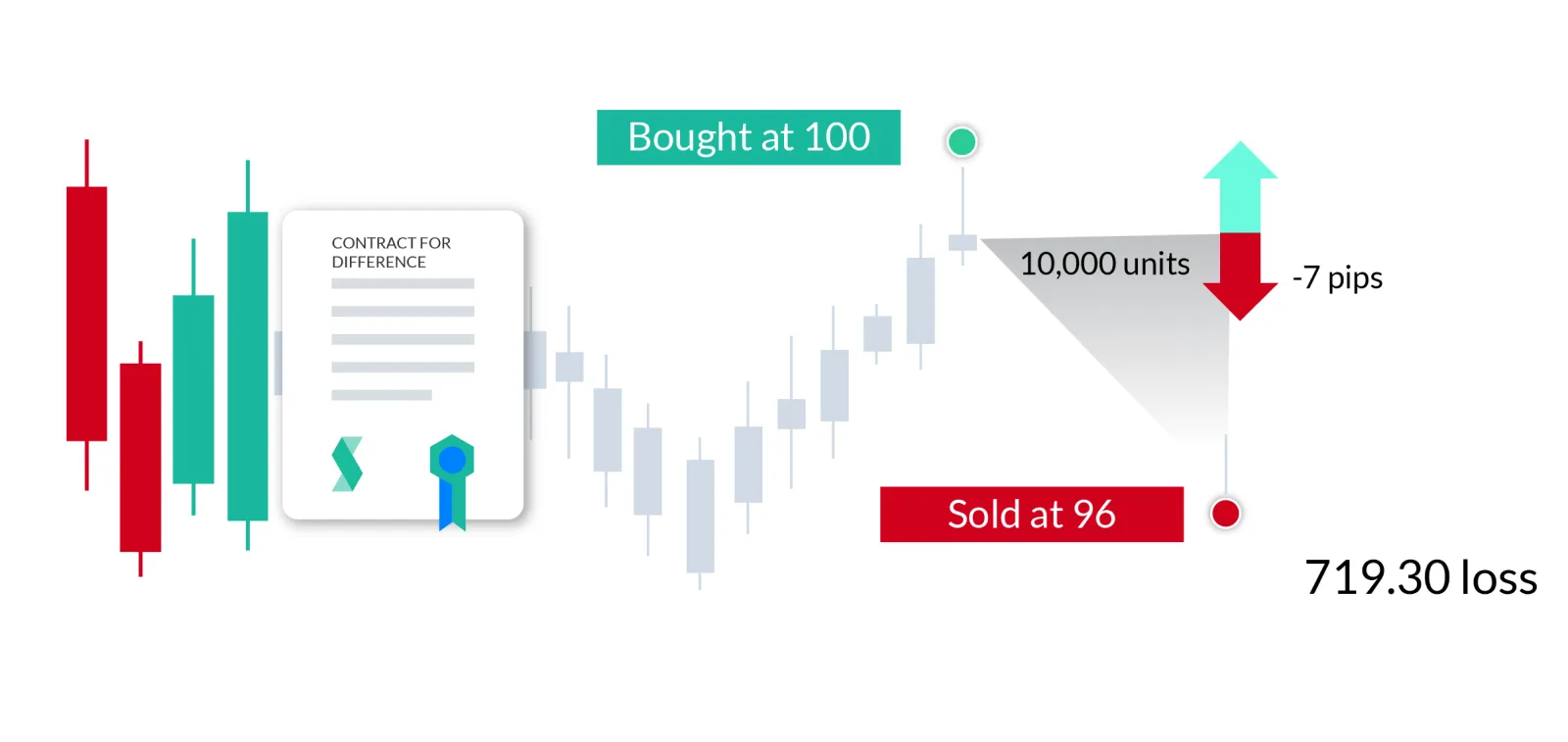

The exposure that leverage provides in CFD trading affects winning or losing trades. In the example below you’ll see the impact leverage has both ways. Profits and losses are calculated by looking at the difference in price between the initial price at which the CFD is bought or sold, and when the trade is exited (based on the speculation of asset prices in specific market conditions).

What is Selling short?

It is simply the opposite of buying “long” - the only significant difference is which direction you expect the stock price to move in. A short position is one that bets against the market, profiting when prices decline while a long position involves buying an asset in hopes the price will rise.

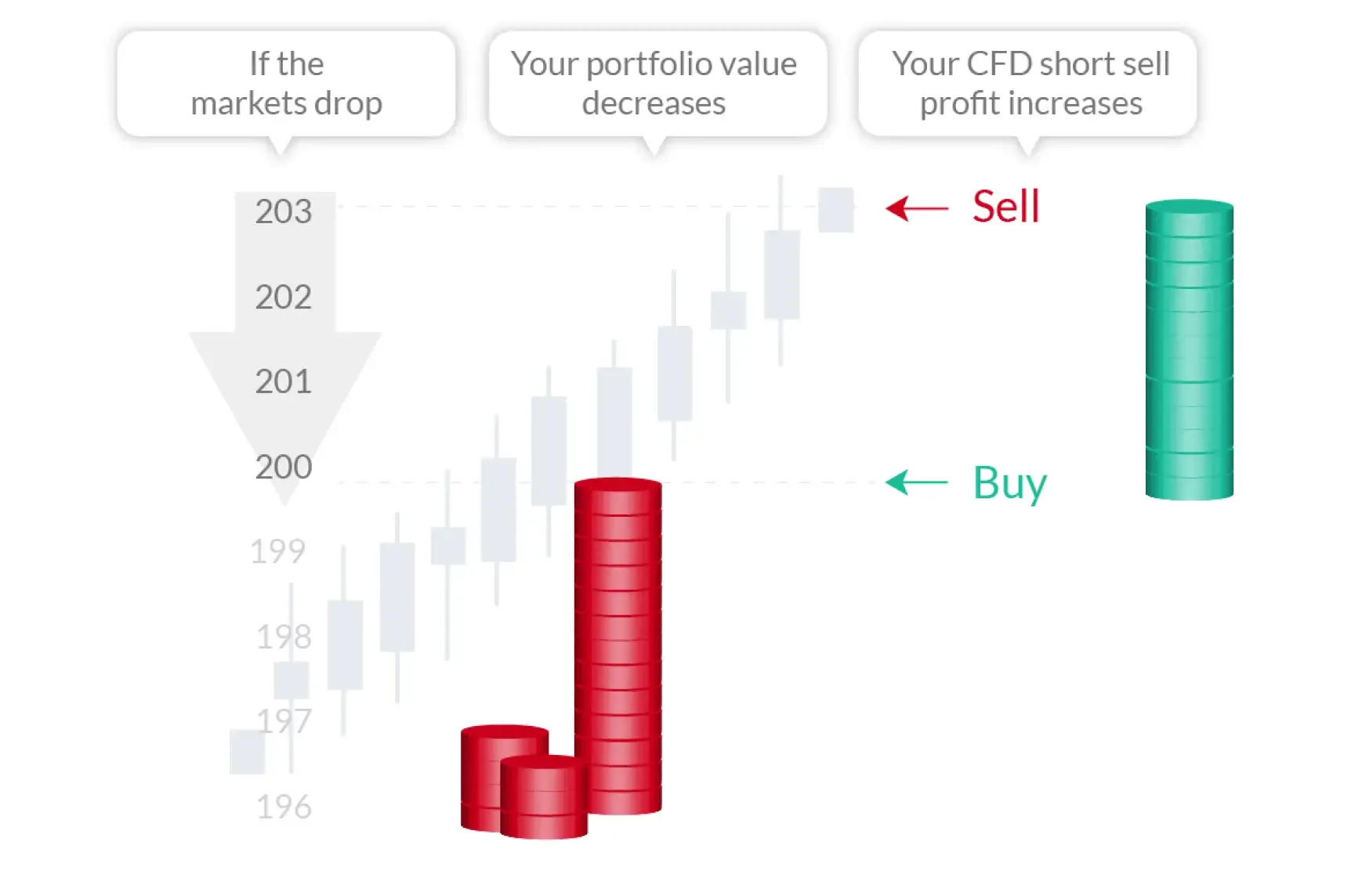

Short-selling CFDs in a falling market

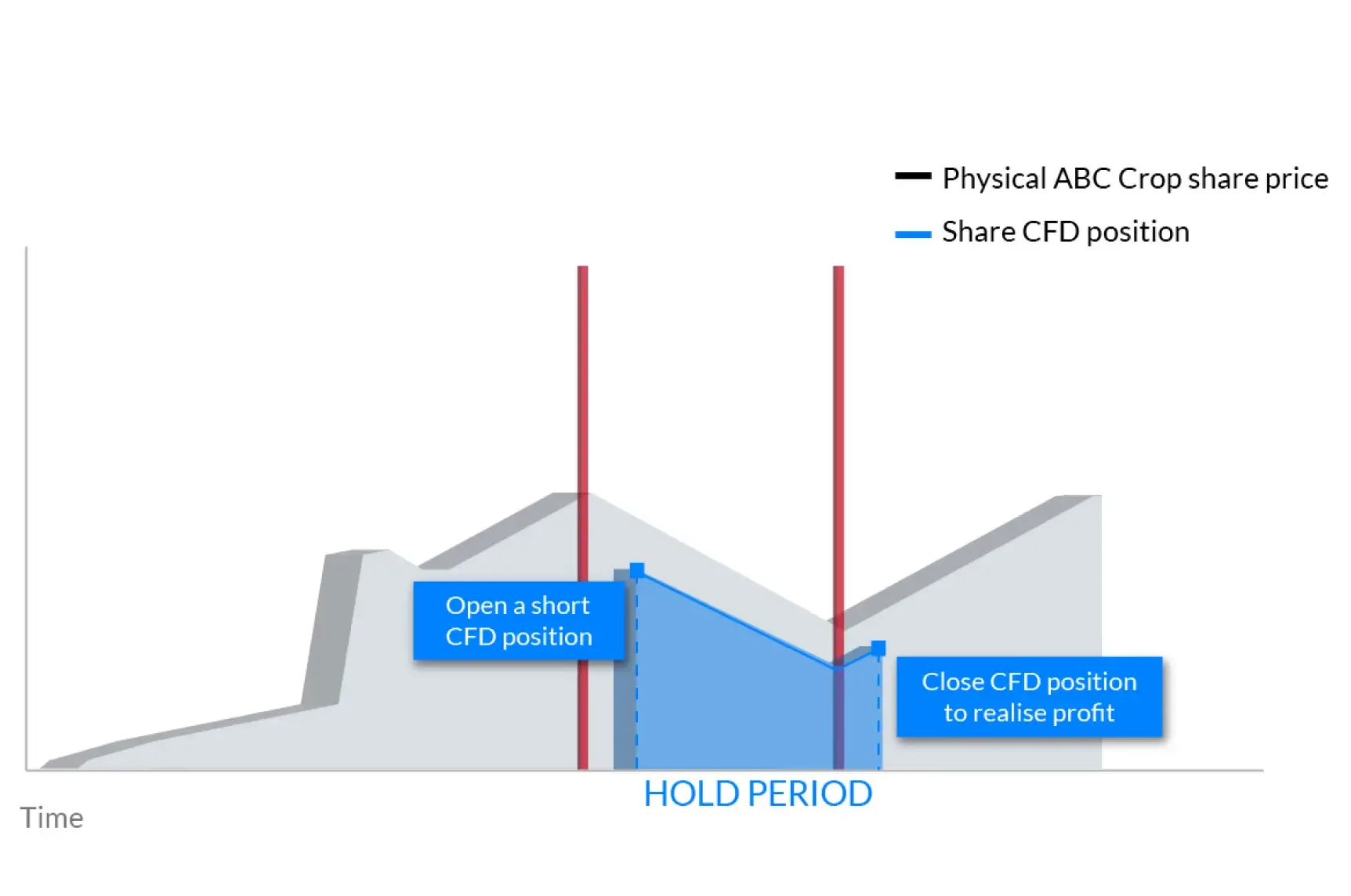

Hedging your physical portfolio with CFD trading

3 reasons why traders prefer CFDs

- It provides investors with all of the benefits and risks of owning a security without actually owning it.

- The use of leverage allows investors to put up a small percentage of the trade amount.

- Investors are able to easily take a long or short position or a buy and sell position.

At a quick glance

| Advantages of CFDs | Disadvantages of CFDs |

|---|---|

| Higher leverage | Traders pay the spread |

| Professional execution with no fees | Regulated only in some jurisdictions |

| No day trading requirements | Higher risks |

| Global market access from one platform | |

| No shorting rules or borrowing stock |

What markets can I trade?

With Skilling, you get fast, flexible access to the financial markets, all in a single trading environment! You can trade CFDs on 1000+ instruments from a variety of asset classes including FX, Metals, Energy, Stocks, Indices, ETFs, as well as Cryptos (in some regions),and with an initial deposit of only €100!

Stocks

905 instruments

Indices

17 instruments

Commodities

21 instruments

Forex

74 instruments

Cryptocurrencies

60 instruments

Why trade CFDs with Skilling?

Trade on both rising & falling markets

Open either short or long positions according to the market conditions and your trading strategy.

Leveraged trading

You need significantly less capital to open a trade in comparison to owning the underlying asset. Leverage can significantly increase your gains as well as losses.

Regulated environment

Trading with Skilling ensures a regulated environment, with segregation of all client deposits, and client-focused customer support.

Fast execution

Ultrafast order execution. No dealing desk intervention. Orders get routed automatically to our LPs, ensuring your trade is always matched and filled quickly.

Wider Offer of Instruments

Traders have access to all types of markets at any time, all from a single trading platform, via web, tablet, or mobile phone. Trade on-the-go with Skilling!

Hedging

Prevent potential losses when owning real assets; if you believe their share price will go down, you can use CFDs to ‘short’ them. If your speculation is correct, you can make a profit from the position.

How do CFDs compare against other financial assets?

CFDs vs other financial assets

Share CFDs

Share dealing

Available to retail clients?

Leverage?

Ownership of shares?

Timeframe

Platforms

mobile trading app and MT4

mobile trading app and MT4

What are the costs of CFD trading?

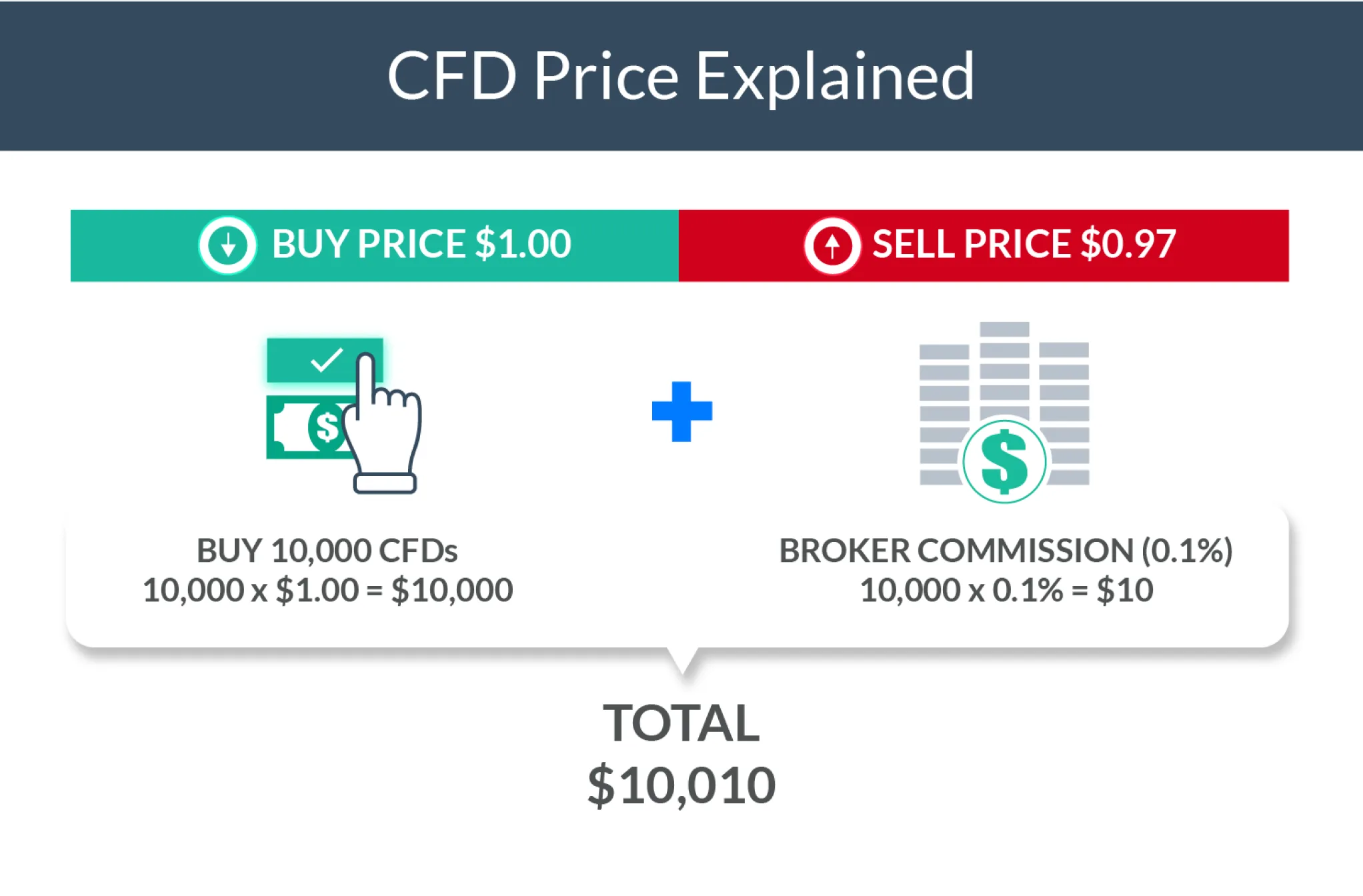

Spread

When trading CFDs you pay the spread, which is the difference between the buy and sell price. This is our charge for executing your trade. If you enter a buy trade you use the buy price quoted and exit this trade, using the sell price, and vice versa.

The narrower the spread, the less the price needs to move in your favour before you start making a profit; or if the price moves against you, a loss. We offer consistently competitive spreads and work tirelessly to keep these charges among the lowest in the business.

Swap fees (a.k.a interest, rollover or overnight fees)

At the end of each trading day (at 21:59 GMT), any positions open in your account may be subject to a charge called a swap fee, a cost which can be positive or negative depending on the direction of your position and the applicable interest rates.

Please note: calculation formula may vary according to instrument type.

How much will I have to pay?

More info on spreads, commissions and other fees and charges can be found here.

Holding costs

- Spread and commission

- Deal size

- Duration

- Profit and loss

How do I trade CFDs?

- Open a trading account

- Find an opportunity

- Take a position

- Monitor your position

Outcome A: a profitable CFD trade

Outcome B: a losing CFD trade

Got questions? We’re here to simplify trading.

What are the differences between trading and investing?

Investing and trading are two different methods of attempting to profit in the financial markets. Investors seek larger returns over an extended period through buying and holding, which involves less risk, whereas traders take advantage of both rising and falling markets to enter and exit positions over a shorter time frame, taking smaller, more frequent profits, but at higher risk.

What is the minimum deposit you need to trade CFDs?

Minimum deposits can differ between brokers, and sometimes even change with the same broker over time, so it is not fixed. Skilling’s minimum deposit currently can be found here.

How can you manage risk when trading CFDs?

Plan, educate yourself on the markets by studying market analysis, observe more experienced traders, and read as much as you can about it, and practice, practice, practice on demo accounts!

How do you ensure the safety of my deposited funds?

Skilling takes the safety of client funds very seriously. For this reason, all client funds are fully segregated from the company’s own funds and kept in separate bank accounts in major European banks. This ensures that client funds cannot be used for any other purpose. Furthermore, clients of Skilling Ltd are protected by the Investor Compensation Fund for Customers of Cypriot Investment Firms (CIFs) which protects customers’ funds up to a specific amount in the case of the company’s insolvency. For more information please visit CySEC’s website.

More questions?

Check out this page, and if you don’t see what you are looking for, please message us about it. We’re here to help: 15 hours a day, from Monday to Friday, 6am to 9pm GMT.

Start trading