With global expansion, the need to complete transactions in international currencies continues to grow. The Foreign Exchange, or FX or Forex as it is commonly referred to, is a global marketplace where currencies are traded. Forex trading is one of the most popular types of trading worldwide, and one of the most actively traded markets internationally, since it relates to the conversion of one national currency into another.

The FX market provides a means of hedging that risk by fixing a rate at which the transactions can be completed at a later date. Investors speculate the market when trading forex, in the hopes that the currencies traded will gain or drop in value resulting in a profit.

Why is Forex trading so popular? It is one of the most popular financial markets because, in particular, the major currency pairs are traded in extremely high volumes giving the market high liquidity. It is because of this size it is thought that forex trading is the most lucrative market out there.

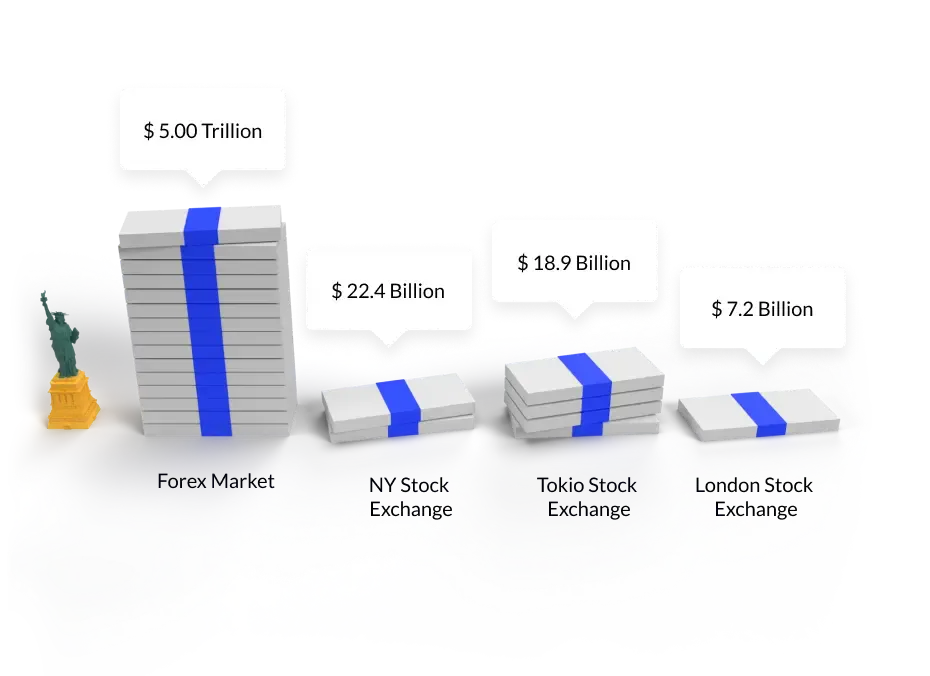

On a daily basis, national currencies are exchanged against one another worldwide, creating a daily average trading volume of 5 trillion, making it the largest financial market in the world.

How does

Forex Trading work?

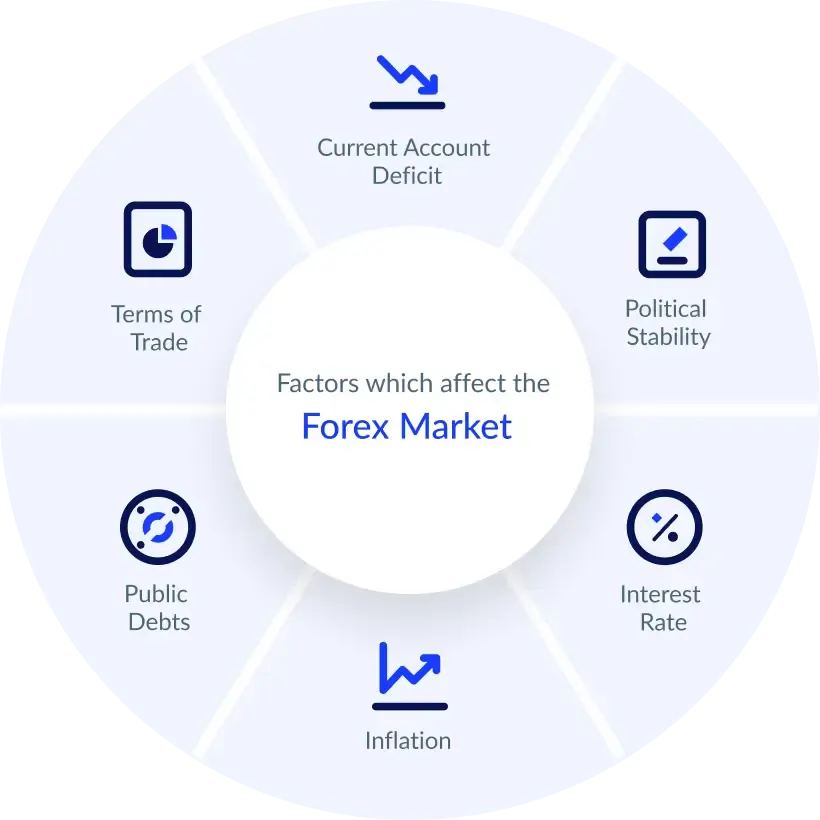

Forex trading is affected by the volume of currency forex brokers buy or sell everyday, which affects price movements, making some currencies extremely volatile. Other factors to take into account that may affect FX trading are commercial activities, politics, changes in inflation/interest rates or recessions and war.

Unlike stocks and commodities , there is no central exchange. Instead, currencies are converted via a global network of banks, dealers and financial brokers all over the world. The volatile nature of the market attracts many traders as there is an opportunity for high profits alongside the increasing risk.

When can I trade Forex?

The Forex market is traded 24-hours a day. From Sunday night through Friday night, trading takes place around the world. This means that investors should almost always be ready to respond to currency fluctuations. As the markets are constantly moving, monitoring your position and utilising appropriate risk management software is key.

Short and long Forex Trading explained

We offer CFD trading on over 74 top-traded forex pairs. Go long or short on major, minor and exotic forex pairs, and get access to hundreds of daily trading opportunities on the forex market with Skilling.

What are the costs of CFD trading?

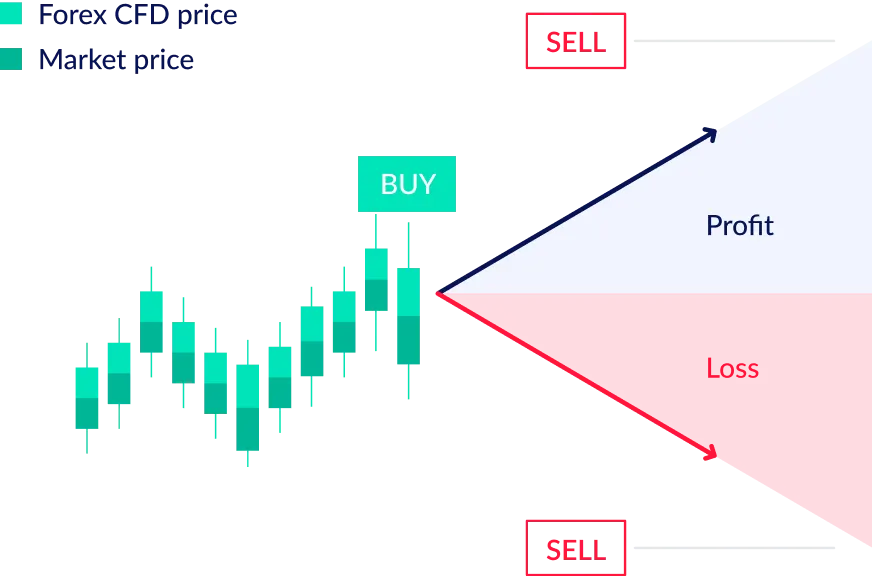

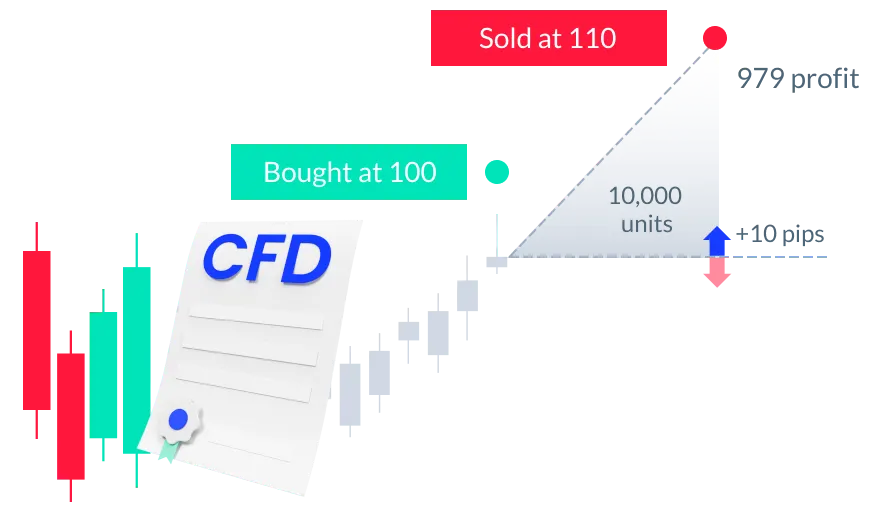

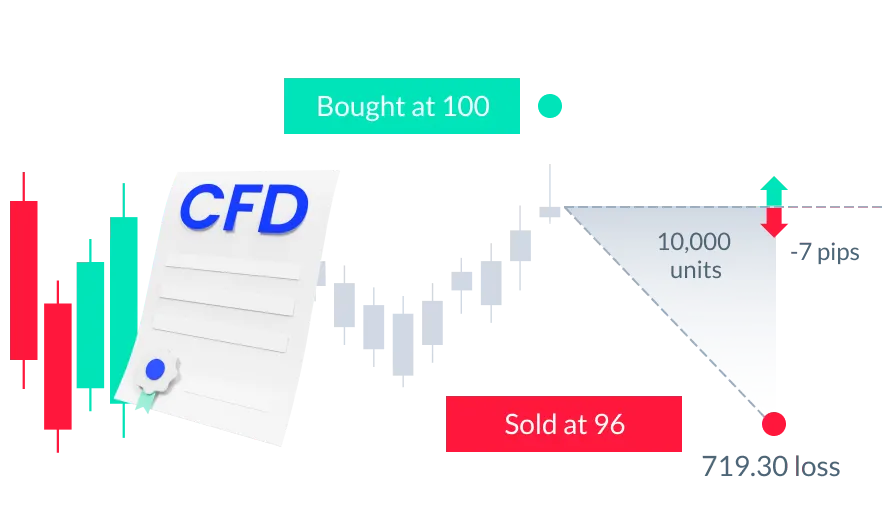

When trading CFDs you pay the spread, which is the difference between the buy and sell price. This is our charge for executing your trade. If you enter a buy trade you use the buy price quoted and exit this trade, using the sell price, and vice versa.

The narrower the spread, the less the price needs to move in your favour before you start making a profit; or if the price moves against you, a loss. We offer consistently competitive spreads and work tirelessly to keep these charges among the lowest in the business.

Outcome A: a profitable CFD trade

Outcome B: a losing CFD trade

To find out more about swap fees and other trading costs, visit our CFD trading page.

An advantage to CFD Forex Trading

A key advantage is what is called Leverage. This means you only need to put up an initial deposit, or margin, to enter a trade. Margins can vary depending on regulations, currency pairs and which platform you choose to use. Margin trading can be a more efficient way of using your capital because you only need to present a percentage of the overall value, whilst remaining fully exposed to the fluctuations in the market. This essentially means you can increase your potential profit if the market trends in your favour. To find out more about leverage, click here.

Benefits of CFD trading / Why trade CFDs with Skilling?

Trade on both rising & falling markets

Open either short or long positions according to the market conditions and your trading strategy.

Leveraged trading

You need significantly less capital to open a trade in comparison to owning the underlying asset. Leverage can significantly increase your gains as well as losses.

Regulated environment

Trading with Skilling ensures a regulated environment, with segregation of all client deposits, and client-focused customer support.

Fast execution

Ultrafast order execution. No dealing desk intervention. Orders get routed automatically to our LPs, ensuring your trade is always matched and filled quickly.

Wider Offer of Instruments

Traders have access to all types of markets at any time, all from a single trading platform, via web, tablet, or mobile phone. Trade on-the-go with Skilling!

Hedging

Prevent potential losses when owning real assets; if you believe their share price will go down, you can use CFDs to ‘short’ them. If your speculation is correct, you can make a profit from the position.

What are the most traded Forex pairs?

There are many currencies traded in the market and these are split into three sections: Major, Minor and Exotic pairs. Major forex pairs refer to all currency pairs comprising any two of the following currencies: US Dollar, Euro, Japanese Yen, Pound Sterling, Canadian Dollar, or Swiss Franc.

Top 4 Major currency pairs

What are Exotic pairs?

Exotic pairs are currencies from emerging economies, which are then paired with major currencies or other exotic currencies and traded. These pairs have the least frequent trades when compared to major and minor pairs. Here are some examples:

What are Minor pairs?

Minor pairs have a smaller market share compared to major pairs, but still a very decent level of liquidity.

These pairs are made up out of any combination of the following currencies:

- Euro

- British Pound

- Canadian Dollar

- Australian Dollar

- Japanese Yen

- Swiss Franc

- New Zealand Dollar

Got questions? We’re here to simplify trading.

Who owns Forex and where is it located?

No one, in particular, owns Forex. It isn't connected to any specific country or government organization. Its transactions are conducted only between two participants — the seller and the buyer. So as long as the current banking system exists, Forex is here to stay.

What are the working hours of the Forex market?

The Forex market is open from 22:00 GMT Sunday (opening of the Australian trading session) till 22:00 GMT Friday (closing of the US trading session). There are holidays when the trading schedule changes and certain markets are closed or close early. This varies month-to-month, but a dependable broker like Skilling will inform its clients of any changes to the market times. Check out our trading article on Forex trading hours and how they affect your trading.

What are long and short positions?

A long position is a buy position, meaning that this position will be in profit if the currency rate goes up. A short position is a sell position, meaning that this position will be in profit if the currency rate goes down.

What is the best Forex trading strategy?

There is none. You should constantly develop your own strategies for every possible market situation if you want to be in profit. Specific Forex strategies can only be good for a limited period and for specific currency pairs. Click here to find out more about forex trading strategy.

Can I lose more than I invest in Forex?

Normally, no. The broker will not allow you to lose more than you have in your trading account. It will simply close your losing position when the resulting account balance reaches close to zero. Any loss that exceeds a trader's deposit is a direct loss of the Forex broker, therefore it is in the broker's best interests to prevent such losses. In rare cases, a slippage or significant price gap may put the trader's balance into negative territory, but there are measures in place to prevent this. And it is rare that brokers will pursue traders to refund negative account balances

How much will I have to pay?

Info on spreads, commissions, and other fees and charges can be found here.

How can I start trading Forex?

Just click here to get started!

More questions?

Check out this page, and if you don’t see what you are looking for, please message us about it. We’re here to help: 15 hours a day, from Monday to Friday, 6am to 9pm GMT.

Start trading