Trading coffee and other soft commodities

In the world economy, there are few markets more important than the commodity market. It is one of the largest on Earth, representing more than $5 trillion in annual trade.

Commodities are those vital raw materials that produce the goods that we use every day. The most prominent examples include gold, natural gas, and crude oil. However, these are all known as hard commodities. An equally important but often overlooked market is the soft commodities market.

This term describes materials that are usually grown, rather than mined. Some of the top entrants on any global soft commodities list might include coffee, soybeans, cotton, and sugar, all essential materials, and high-demand markets. Because of the value and consistent demand for these materials, investors have sought exposure to commodities markets since time immemorial.

Today, commodities are more popular among investors than ever. Inflation and supply chain disruption has led to spiralling prices and rising demand, making certain commodity markets some of the most promising growth prospects for 2022. Even retail investors can now engage in commodities CFD trading, speculating on the future price of coffee or gold. Before you get started on that, make sure to read our soft commodities explainer to find out how these complex markets work, and why some people invest in them.

Key commodities explained

Coffee

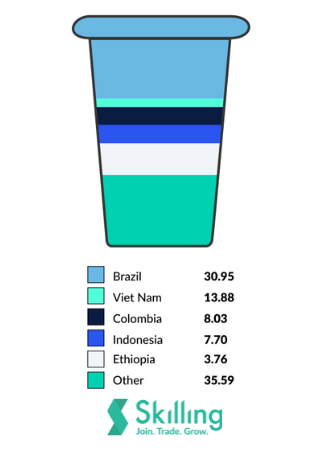

Coffee is one of the most valuable commodity markets in the world, estimated to produce $460 billion in revenue in 2022 alone. Coffee requires a very specific climate to grow, which is why the commodity coffee market is dominated by a handful of low and middle-income countries.

The largest coffee exporters in the world are Brazil, Vietnam, and Colombia. Meanwhile, the largest importer of coffee in the world by a very wide margin is the United States.

For those looking to trade coffee, it is worth noting that prices are usually given on commodities indices by the ounce and that prices have risen consistently throughout the past few decades. In 2022, following global supply chain disruption, coffee prices have soared to heights few could have predicted.

Price volatility surrounding the price of coffee per ounce is nothing new. Several real-world scenarios can influence the global supply and demand for coffee. In terms of demand, emerging nations and their increasing disposable income are creating new markets for coffee producers to tap into.

However, supply is linked intrinsically to our climate. Rising temperatures threaten to destroy much of the arable land used to grow coffee beans. Approximately 16% of Ethiopia’s population work in coffee production, so climate change poses a seismic threat to the Ethiopian economy, alone.

Soybeans

Soybeans are a major agricultural crop that is used to produce a wide range of products, including animal feed, soy milk, biofuel, tofu, and oil. The market is worth around $50 billion a year, with production dominated by a small handful of countries.

Chief among these is the US, which produces 1.9 billion tons of it every year, making up a third of the global market. However, Brazil recently overtook the US as the top producer. Other major producers include Argentina, China, and India. Soybeans are traded on global markets in US dollars, and global prices are currently near an all-time high.

As with other soft commodities, inclement weather can have a major bearing on soybean yields in rural America and beyond. A poor crop can lead to demand outstripping supply, forcing prices up. It’s also true that the price of soybean yields is influenced by the strength of the US dollar. If the greenback is strong in the forex markets, the price is more likely to rise. With many other major currencies, like the British pound and euro looking weak amid the cost-of-living crisis, it’s no surprise that soybean prices have hit north of $1,500 per ton.

Cocoa

We all love chocolate, but very few know how it is produced. Chocolate is derived from the cocoa bean, with major chocolate manufacturers in Europe usually buying cocoa beans from producers in Africa and Latin America, in the very countries where it is possible to cultivate this resource-intensive crop.

By far the largest cocoa producer in the world is the Côte d'Ivoire, responsible for around 35% of all production. They are followed closely by Ghana, Indonesia, and Nigeria.

Perhaps surprisingly, global cocoa prices have fallen or remained stagnant in recent years, which some have argued reflects falling demand for chocolate. However, rising prices of related commodities like sugar could contribute to a bump in cocoa futures at some point.

Cocoa prices are also at the mercy of two issues – yield shortfalls and political instability. The Côte d'Ivoire has been particularly plagued by political problems, with a bitter civil war and an attempted military coup since the turn of the millennium. These heightened tensions in West Africa resulted in the price of cocoa hitting $4,200 per ton back in March 2011.

Palm Oil

Palm oil is a vegetable oil produced from oil palms, and it makes up around a third of the global oil market. It is used in a vast array of everyday items, including butter, cooking oil, shampoo, biofuel, and even in medicine. It is one of the most valuable commodities on the planet, one that is worth an estimated $66 billion worldwide in 2022. The biggest producer of palm oil by far is Indonesia, which is responsible for 47% of global production, exporting 442 million tons of the stuff last year.

Owing to the tropical climate required for oil palms to thrive, the next largest global producers are Malaysia and Thailand. While these countries used to produce levels close to Indonesia's, this has changed over the past decade as Indonesian production has shot up. Like many other commodities, the price of palm oil has skyrocketed over the past year and now sits at an all-time high.

Several factors influence the value of crude palm oil. Firstly, inclement weather patterns can negatively impact yields, with periods of drought or flooding curbing palm oil output. As crude palm oil is produced largely in southeast Asian nations, it is a vital export for their respective economies. Therefore, the import policies adopted by their strongest trading partners – typically India and China – can either lift or impose trade barriers and affect demand.

Cotton

The cotton plant is essential for the production of the fibres we need to make clothes, books, coffee filters, and even cooking oils. It is native to many regions around the world, including the Americas, Northern Africa, and India. Cotton production takes up around 2.5% of the world's arable land, with raw cotton often being exported to additional countries for processing, before being exported again to be transformed into an end-product.

For years, the United States had been the largest cotton producer in the world, but China has now surpassed it, producing 21% of the world's cotton and exporting 235 million tons of it last year. Again, supply chain disruption and soaring demand have caused the price of cotton futures to skyrocket over the past 12 months, with prices now sitting at historical highs.

The price of cotton futures is also heavily linked to indicators regarding the health of the global economy. Poor economic conditions, such as the ongoing cost-of-living crisis driven by surging inflation, can force cotton prices down fast. That’s because shoppers are more likely to seek out budget-friendly garments such as polyester when disposable income is diminished. Global oil prices have a similar role to play, given their integral role in cotton production. The high values of crude oil can hit the margins of cotton producers hard.

Capitalise on volatility in commodity markets

Take a position on moving commodity prices. Never miss an opportunity.

Should I have commodities in my portfolio?

For many traders, investing in soft commodities is a useful hedge at a time of stock market turmoil. While supply chain and demand issues are wreaking havoc on, say, tech stocks, they have caused the price of many major commodities to reach record heights.

Commodities also have an inherent value that some other tradable assets lack, as commodities will always be in-demand around the world thanks to their use in essential everyday items.

The risks associated with trading commodities are also important to understand. Unlike shares or ETFs, commodity futures are leveraged financial instruments, which means that losses may be magnified if the market moves against you. There may not be any way for you to mitigate the risk of certain commodities due to their volatility. For this reason, this type of instrument is usually suited to more experienced traders.

If you're ready to gain exposure to soft commodities, we're here to help you get started. At Skilling, you can trade commodities CFDs to speculate on commodities' futures and take your position in these dynamic and increasingly important global markets.

Not investment advice. Past performance does not guarantee or predict future performance.