Disclaimer: This information is sourced from reputable financial sites of Forbes, Fortune and TradingView. It reflects thorough research, and economic events can considerably alter market conditions, and in turn the forecast potentially changes; however, you are encouraged to conduct your own research and seek professional advice to make informed decisions.

AMC Entertainment Holdings, Inc. (AMC) is a prominent player in the entertainment industry, operating a large chain of movie theatres globally. The company has faced significant challenges, particularly during the COVID-19 pandemic, which led to a decline in its stock price.

However, AMC has also experienced periods of remarkable growth, notably in 2021, when it became a "meme stock" driven by retail investor enthusiasm, reaching an all-time high of $339.02.

This article comprehensively analyzes AMC share predictions from 2024 to 2050, offering insights into the company's potential future performance based on various technical and fundamental factors.

Key takeaways: AMC share prediction

AMC Entertainment Holdings' share price is expected to experience significant fluctuations from 2024 to 2050, influenced by various technical and fundamental factors. By September 2024, the share price is predicted to reach $5.82, with a minimum price of $4.42, driven by the release of new movies and debt reduction efforts.

Long-term predictions suggest the stock could reach $1000 by 2030, although more conservative predictions indicate a modest increase to $22.96. By 2050, the stock price is expected to range from $14.59 to $432.13, depending on the company's ability to navigate market challenges and capitalize on new opportunities.

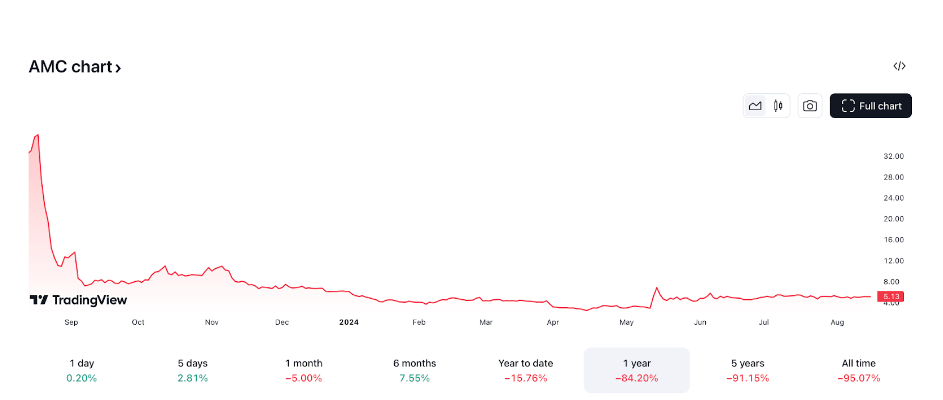

Source: TradingView.com, Friday 16 August, 2024, 11:44 GMT

AMC share prediction September 2024

According to recent predictions, AMC's share price is expected to reach $5.82 by the end of September 2024, with a minimum price of $4.42. This projection is based on various technical indicators and market trends.

The current sentiment around AMC is bearish, with a Fear & Greed Index showing 39. This indicates that investors are cautious about the company's prospects. However, with the expected release of new movies and the company's efforts to reduce debt, there's a possibility of a turnaround.

From a technical analysis perspective, AMC's 50-day SMA is currently $5.02, and the 200-day SMA is $5.19. These indicators suggest that the stock is trading below its long-term average. However, it's crucial to consider other factors, such as the company's financials and industry trends, before making any investment decisions.

The company's revenue projections 2024 are around $4.67 billion, which is lower than pre-pandemic levels. This could concern investors, but it's also important to note that AMC is reducing debt and improving its financials. With the right strategy and a bit of luck, the company could turn things around and see significant growth in the future.

AMC share prediction October 2024

According to reputable sources, the AMC share price is expected to reach a maximum price of $7.51 and a minimum price of $6.04 in October 2024. This prediction is based on a comprehensive analysis of various technical and fundamental factors, including the company's financial performance, industry trends, and market sentiment.

The AMC share price has been on an upward trend since the beginning of 2024, driven by the company's improved financial performance and the increasing demand for entertainment services. In the third quarter of 2023, the company reported a net income of $12.3 million, compared to a net loss of $227 million in the same period of the previous year. This significant improvement in financial performance is expected to continue in the fourth quarter of 2024, driven by the company's efforts to reduce costs and improve operational efficiency.

AMC share prediction November 2024

According to AMC stock predictions, the share price is expected to reach between $5.52 and $6.93 in November 2024. Analysts predict the stock will begin the month at around $5.52 and rise to a maximum of $6.86, with a minimum price of $5.52. The average projected price for AMC shares in November 2024 is $6.06, with the stock ending the month at approximately $6.35.

AMC's stock performance in November 2024 will likely be influenced by its ongoing efforts to reduce debt and improve its financial position. In 2023, AMC raised $865 million through share offerings, which it used to pay down a significant portion of its debt. However, the company's openness to continued equity offerings in 2024 raises concerns about potential share dilution, which could negatively impact the stock price.

AMC share prediction December 2024

According to analysts, AMC's share price is expected to reach $6.80 by December 2024, representing a year-to-year change of +11%. This prediction is based on the company's improved financial performance, including a projected revenue of $4.67 billion for 2024. While this falls short of pre-pandemic levels, it marks a significant improvement from the company's revenue in 2023.

The predicted share price of $6.80 is also influenced by AMC's efforts to reduce its debt burden, which has been a significant concern for investors. The company's successful conversion of its preferred shares, APEs, into common shares has injected $865 million into the company, which has been used to reduce its debt. This move has improved AMC's financial stability and reduced the risk of share dilution.

However, it's worth noting that AMC's trading dynamics are shifting from "meme craze" volatility to a more fundamental focus on business performance. This shift may lead to a more stable share price, but it also means that investors will pay closer attention to the company's financial performance and growth prospects.

AMC share prediction 2025

The year 2025 is expected to be a turning point for AMC Entertainment Holdings, with many market watchers predicting a significant increase in the company's stock price. According to some estimates, AMC's stock price could reach $60 by 2025, driven by the company's efforts to reduce its debt and improve its financial performance. This prediction assumes that the company can shift its high-interest debt to better terms or possibly pay it down by then.

AMC's stock price has been heavily influenced by the actions of retail investors, particularly those on the Reddit forum Wall Street Bets. In 2021, these investors played a significant role in driving up the company's stock price, and some predict that they could do so again in 2025. However, it's worth noting that the stock market can be highly unpredictable, and there are no guarantees that AMC's stock price will reach $60 by 2025.

Capitalise on volatility in share markets

Take a position on moving share prices. Never miss an opportunity.

Regarding specific price predictions, some analysts have predicted that AMC's stock price could reach $9.38 by the first half of 2025, with a potential high of $10.44 by the end of the year. Others have predicted that the company's stock price could reach $6.30 by the first half of 2025, with a potential high of $7.21 by the end of the year.

AMC share prediction 2030

AMC Entertainment Holdings' stock price is projected to experience substantial growth by 2030, with some estimates suggesting it could reach as high as $1000 per share. This optimistic outlook assumes that the company will successfully navigate its high-interest debt and improve its financial performance. However, such long-term predictions are inherently speculative and should be cautiously treated.

In contrast, more conservative projections suggest a more modest increase, with the stock price potentially reaching around $22.96 by 2030. This prediction is based on a more gradual growth trajectory, taking into account the company's historical performance and market trends.

AMC share prediction 2040

In 2040, AMC's stock is anticipated to show a positive trend, with an average price target of $6.8695, representing a 34.17% increase from its previous levels. Despite its recent challenges, this prediction reflects optimism about AMC’s ability to adapt to the changing entertainment industry. The company's strategic initiatives will likely contribute to this upward trajectory, including debt reduction and expanding its content offerings.

The entertainment industry is expected to evolve, with AMC potentially benefiting from new content distribution models and partnerships with renowned artists. These developments could enhance AMC's market position and drive investor confidence, leading to a more robust performance by 2040.

AMC share prediction 2050

AMC's stock price in 2050 is projected to range significantly, with estimates suggesting a minimum of $14.59 and a maximum of $432.13. The potential for a high of $432.13 suggests a scenario where AMC successfully navigates market challenges and capitalizes on new opportunities, possibly through strategic shifts or technological advancements.

The lower end of the prediction, around $14.59, indicates a more conservative outlook where AMC faces ongoing challenges, such as declining movie theatre attendance and increased competition from streaming services.

This scenario assumes that AMC's efforts to diversify and innovate only partially offset these industry pressures. The influence of retail investors, particularly those from online communities like Reddit, could also play a significant role in future price movements, as seen in past short squeezes.

What's your Trading Style?

No matter the playing field, knowing your style is the first step to success.

FAQs

1. What is the future of AMC stock?

AMC's stock has been subject to dramatic fluctuations, partly due to its status as a "meme stock" and the impact of the COVID-19 pandemic on the entertainment industry. Recent projections suggest a bearish sentiment, with predictions indicating a potential decline in stock value by 2.68% to $4.86 per share.

Despite the short-term bearish outlook, some technical indicators suggest growth potential. The stock has shown signs of recovery, gaining 4.18% on a recent trading day, and is expected to rise by 48.56% over the next three months, potentially reaching a price range between $6.44 and $12.16.

This optimistic prediction is supported by buy signals from both short and long-term moving averages, suggesting that the current level may present a buying opportunity for investors. However, the stock remains below its 10-week moving average, a critical technical level, indicating that it still needs to be at an ideal entry point for long-term investors.

2. What is the highest price AMC stock has ever reached?

The highest closing price for AMC Entertainment (AMC) stock was $339.02, reached on June 2, 2021. This all-time high resulted from the stock's significant surge in 2021, driven by the company's efforts to recover from the COVID-19 pandemic. The stock's price has since declined, with the latest price being $5.05.

Historical price data shows that AMC stock has experienced considerable volatility, with its lowest end-of-day price being $2.26 on April 15, 2024. The stock's price has fluctuated significantly over the years, influenced by various market and economic factors.

3. AMC shares dividend

Although the yield and frequency have varied, AMC Entertainment Holdings, Inc. has a history of paying dividends. In 2020, the company paid a dividend of $0.2647 per share, representing a yield of -96.250% on cost. This significant negative yield indicates that the stock price had a substantial drop after the dividend payment, suggesting that investors should be cautious when considering dividend income from AMC shares.

The dividend history of AMC Entertainment Holdings, Inc. shows a pattern of decreasing dividend payments over the years. For instance, in 2024, the company paid a dividend of $0.19 per share, which is lower than the previous year's dividend of $0.2647 per share.